We Deliver Purpose built, high-yield residential investment property

As one of New Zealand’s leading property investment experts, my mission is to help everyday Kiwis secure their future through long-term real estate investments.

With over 29 years of investment property ownership – and 21 years of property development for over 600 delighted customers – I provide experienced and professional leadership for Assured Property and their buyers.

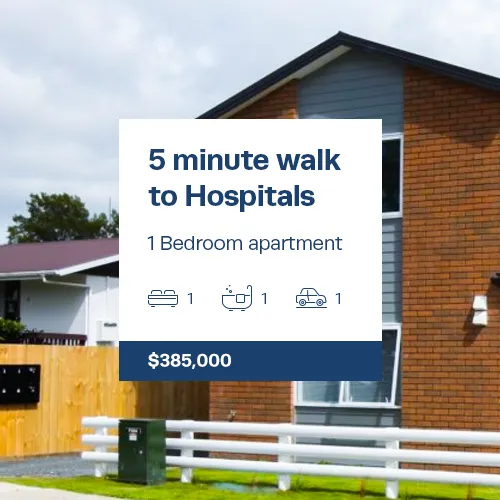

Current Listings

Past Developments

Community Involvement

Momentum Financial Literacy Fund

John and Nicola Kenel, supported by their business Assured Property Investments, recently established a new named fund with Momentum Waikato.

The ‘Financial Literacy Fund’ will support students with critical financial literacy skills needed before they embark on their working careers; change their habits from spend, spend, spend to one where they learn to prioritise money and save for things they need. This fund will instil our youth with hope that they can strive to achieve their goals.

Over the next year before the first round of distributions are made, we want to learn what programmes are out there that we may be able to help support and grow. Talk to us at Momentum Waikato Community Foundation.

Customer Stories

"Super easy to deal with. Very professional. Would definitely work with the team again."

York

"The team at Assured have been great to deal with and have made this whole process of buying a new build and purchasing off the plans seamless. With all of the uncertainty over the last couple of years they have delivered everything they promised in spades."

George

"Great communication. Great people. Great product."

Simon

"I have found John, Ryan and the team at Assured to be highly professional, thorough and most importantly, they are trustworthy."

Rachael

I need another one. Buying brand new and having a 10 year build guarantee is excellent peace of mind.

Brendon W.

“We didn’t have any complaints. We meet every day (me and my daughter) – if something goes wrong, we usually have a bit of a bitch session – but we’ve never done that with Assured Property.”

Philippa

News

Capital Gains Tax: The Real Impact

Labour’s proposed capital gains tax has everyone talking, but most people are stressing about the wrong thing. If you do not want to pay the tax, you can simply avoid the asset. That part is easy.

The real issue is what it does to housing supply.

Medium-density homes in New Zealand are built because everyday investors buy off the plans. Their deposits unlock bank funding and that is what gets projects moving. First home buyers very rarely buy off the plans, so they do not fill that role.

If policy pushes investors out of the market, the pipeline slows. Projects stall. Supply shrinks. Rents rise. We have seen this before with the interest deductibility changes. The government ended up spending more than 400 million dollars a year housing families in motels.

Private landlords supply about 85 percent of rental homes in New Zealand. Government supply is only about 11 percent. If even a small number of private landlords exit, tenants have nowhere to go. Government cannot take them all in.

First home buyers are active right now and that is great. But they do not replace the pre-sales that fund new housing. Remove those pre-sales and fewer homes get built. It is as simple as that.

Watch the full video here:

Assured Newsletter

Be first to know about new developments

Property Development Club

New

The Hamilton Property Guide

2026 issue edited by John Kenel, Assured Property

About Us

21 years of residential investment property development experience

Assured Property began in 2004, based on one simple belief – investing in property should be easy and accessible to every-day New Zealanders.

Assured Property founder, John Kenel, bought his first rental property in 1997. As he learned the ropes of property investing – mortgages, lawyers, banks, rates, and regulations – John yearned for a simpler investment process that was easy to understand, and accessible for first-timer investors.

Six years later, as John continued to develop his portfolio, he was driven to share his knowledge and expertise to others, and create a property investment model that would help other Kiwis experience the benefits that rental ownership provided.

This drive resulted in the creation of Assured Property with their unique offering for retail investors: designing and building properties with both the investor and tenant in mind – creating multi-tenanted residential buildings in high-demand Waikato locations.

With a proven knowledge of what-works-best, Assured Property has fine-tuned their model – right down to establishing each investment with furniture, landscaping, and fittings that are perfect for the specific needs of the rental industry.

The result? A low-risk, reliable, tangible asset that provides immediate yield as well as long-term growth. In short – a high-quality rental investment that is ready for tenants pays for itself – and provides benefits both now, and for the future.

Given John’s entrepreneurial focus and Assured Property’s optimistic, can-do attitude, Assured Property is constantly looking for new ways to delight their customers and simplify the purchasing process.

Assured Property keeps a close eye on economic trends and indicators for the Waikato, allowing them to identify new-growth areas and adapt to the market changes – providing a better investment for the Assured Property buyers.

After 21 years of providing close to 1000 innovative rental property investments for over 600 buyers, Assured Property are trustworthy partners with proven expertise. Encouraging their investors to enjoy the benefits of long-term gains and compounding interest, Assured Property has delivered consistent results for their buyers – allowing them to invest and enjoy their new financial freedom.

Contact Us