Australia’s house prices are rising at the fastest rate in 32 years. Are they pointing at Mums and Dads who buy rental property to save for their retirement? No, they are not. Australia doesn’t have a rule-by-podium socialist government in charge, so instead of blaming responsible adults who are planning for their retirement, they look at the facts.

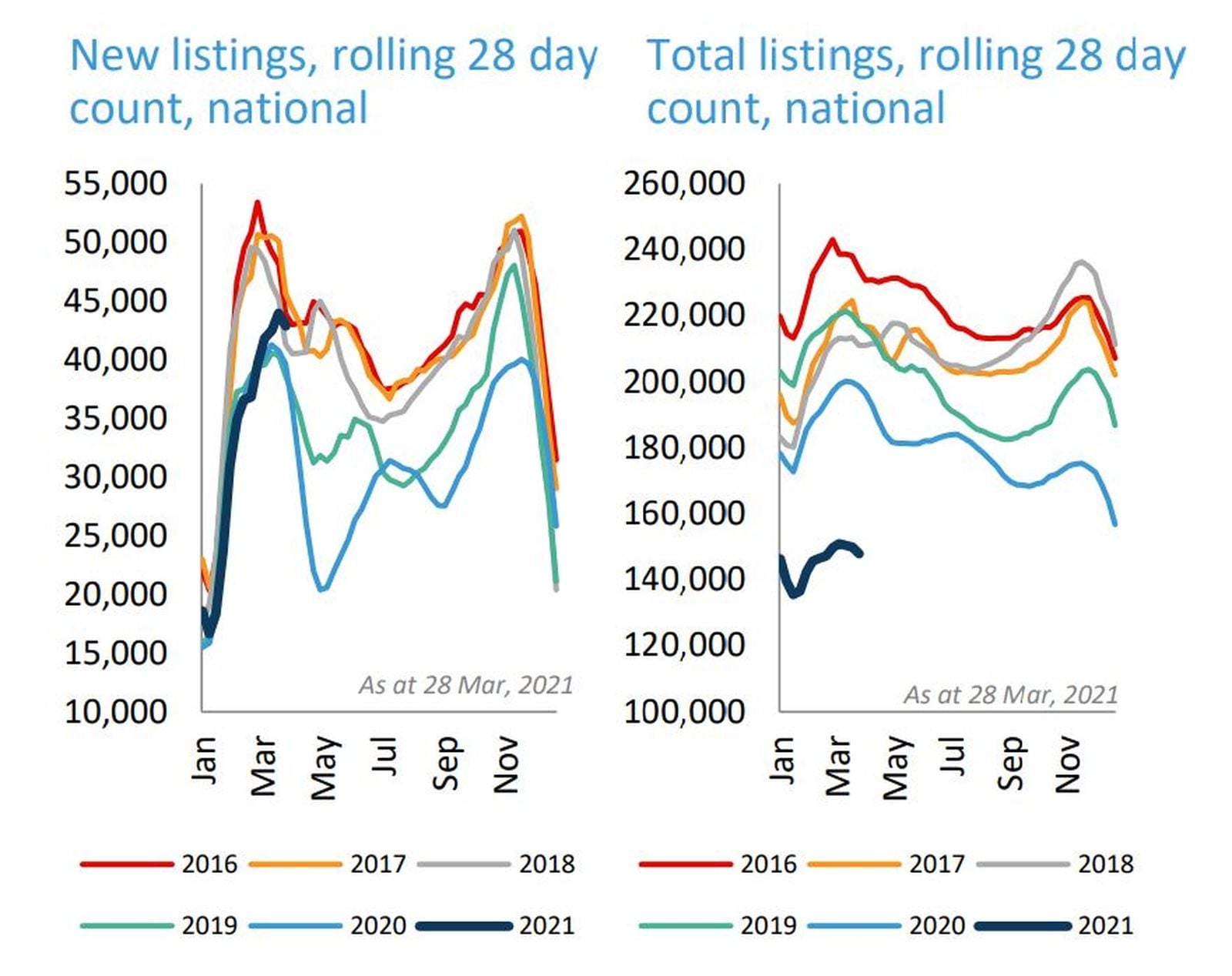

Australia’s property market has more demand than supply with stock levels 25.5% below the five-year average. So a short of houses, just like NZ.

Australians are feeling optimistic as recent economic conditions have consistently beaten forecasts. People are confident in making high commitment decisions related to the property market, just like NZ.

Mortgage interest rates are at record lows. New borrowing in Australia was up 55% on February 2020, prior to Covid, so people are borrowing more, just like NZ.

But Australia’s PM is not jumping up on the podium and screaming “evil property investors, they are stealing your homes!” No, they understand that this is all part of the property cycle and houses prices will once again slow.

“Earlier periods of similar exuberance have been previously quelled by factors such as rising interest rates, weaker economic conditions or changes to credit availability.”

Wouldn’t it be nice if we could have a sensible discussion about housing in NZ. Wouldn’t it be more useful to look at the facts that are actually causing rampant house price inflation, like:

- interest rates have been reduced to record lows

- we have a shortage of housing

- we’ve had years of record levels of migration

- the RMA and councils hamper new development

Only 7% of New Zealanders own a rental property. Are they the cause of high house prices? You’d have to be very naïve to think so.

The fundamental problem is that the market cannot respond to spikes in demand, or even constant demand in the way other markets do, surely there should be some attempts at unshackling the housing market.

John Kenel

CEO

Assured Property

Read the full article at 9news.com.au

#assuredproperty #housing #rentals #propertyinvestment